The State of the Union address did not help stocks on Wednesday, but on the plus side, it did not deal a blow to the markets either. As of now, stocks are simply chopping and consolidating, pondering the next move as major U.S. indices flirt with an overbought condition. Let’s check out a few must-see stock trades for Thursday.

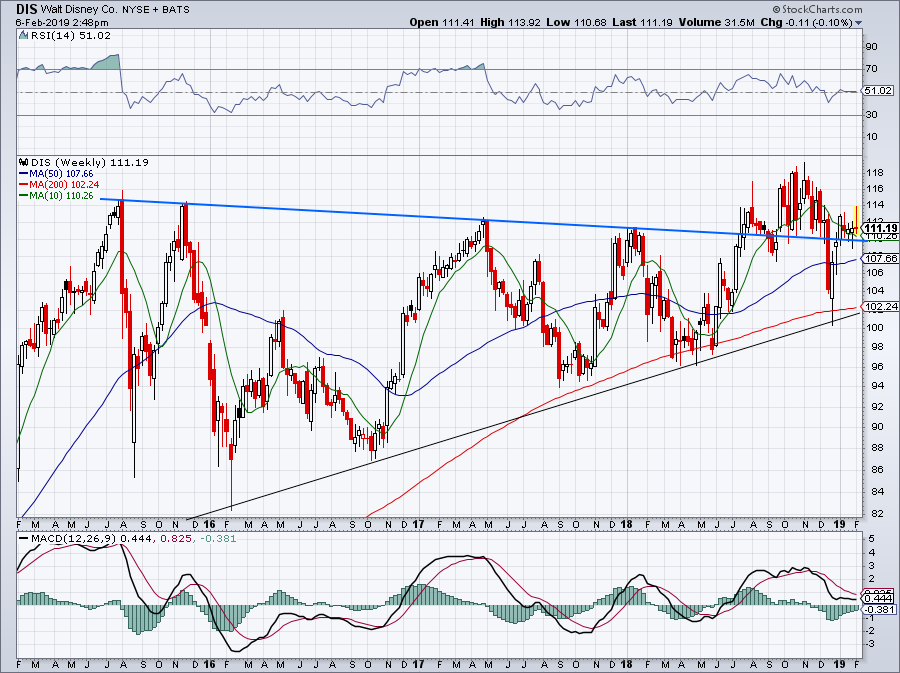

Must-See Stock Trades #1: Disney

Shares of Walt Disney (NYSE:DIS) are struggling Wednesday despite the company beating on earnings and revenue expectations for the first quarter.

However, shares are holding up well on the long-term weekly chart. Over $110 and DIS is still over prior downtrend resistance (blue line). It’s also over its major moving averages. While this is not the earnings reaction that investors were hoping for and while Disney is clearly hitting a tough zone near $114 to $115, it’s hard to get too bearish.

Over downtrend resistance and bulls can stay long. Below and look for a buying opportunity near uptrend support (black line) and/or the 200-week moving average.

Compare Brokers

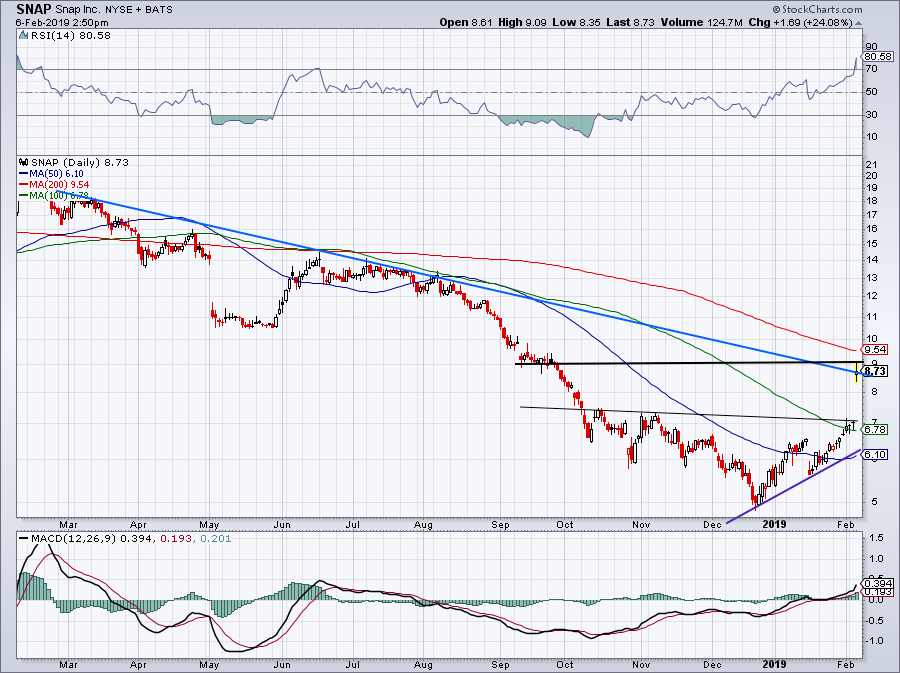

Must-See Stock Trades #2: Snap

I’ve got to give credit where credit is due and in the case of Snap (NYSE:SNAP), bulls deserve some. Shares are up some 25% after the company delivered a better-than-expected earnings result. As much as I don’t like Snap or its long-term business, we’ve got to respect price action.

Bulls who have been long may consider taking profits on this move. Particularly as Snap runs into $9, a former support level, and potential downtrend resistance. Those who want to squeeze out more gains, may see a rise up to $9.60 and possibly even $10 should a short-squeeze really get started.

On the downside, bulls can’t let Snap get back below $7 and the 100-day moving average. If it does, shares are in trouble. Let’s see if it can consolidate near current levels, between Wednesday’s high/low range.

Compare Brokers

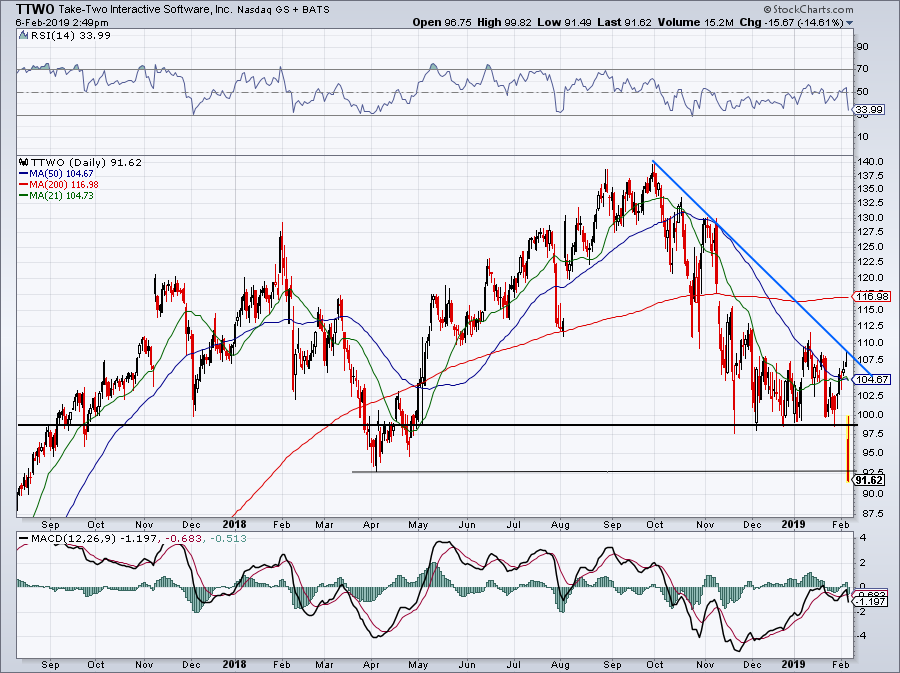

Must-See Stock Trades #3: Take-Two Interactive

Disappointing earnings sacked Take-Two Interactive Software (NASDAQ:TTWO). The move thrust shares below the recent lows near $98, a decent support level where buyers had buoyed the stock price.

Instead, shares took out the 52-week low near $92.50 and are quickly drifting into no man’s land. If it can reclaim the $92.50 level, some investors may find it advantageous to sell some longer dated put options as a way to get long and collect some premium.

However, for traders, TTWO, Electronic Arts (NASDAQ:EA) and Activision Blizzard (NASDAQ:ATVI) have all been under tremendous pressure. I’d wait for a more solid setup before dipping my toe in here. If TTWO stock rebounds but fails to hold $92.50, or rallies up to $98 but can’t penetrate this prior support level, shorts will have a solid risk/reward opportunity.

Compare Brokers

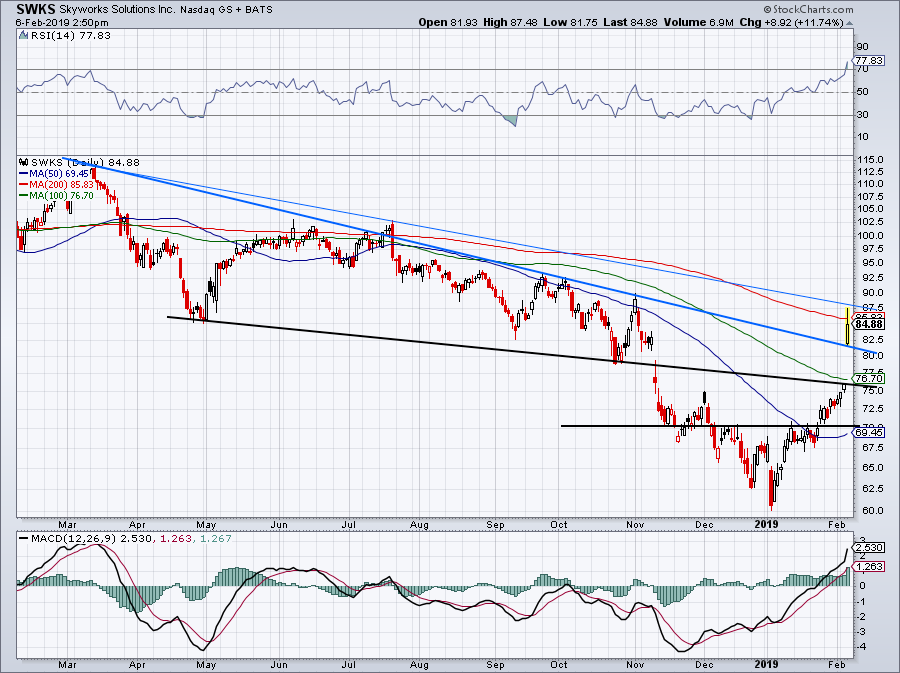

Must-See Stock Trades #4: Skyworks Solutions

The solid-growth, low-valuation play Skyworks Solutions (NASDAQ:SWKS) has not had an easy time. On Wednesday though, shares soared 11.5% after the company reported a mostly in-line quarter and announced a $2 billion buyback plan. That’s no small sum for a stock with a $13 billion market cap.

Depending on how one draws their trendlines, SWKS is running right into downtrend resistance or has cleared it with precision (blue lines). Either way, it’s also hitting the 200-day moving average (and failing at it), while also hitting the 50% Fibonacci retracement from the 52-week high/low range when the stock was near Wednesday’s highs.

That’s a lot of overhead to digest through and may warrant some profit taking over the next few days. I basically want to see it hold over this $82 level now and if it can consolidate, it increases the odds of a further rally in the near future.

Compare Brokers

Must-See Stock Trades #5: Schlumberger

Not much needs to be said here about Schlumberger (NYSE:SLB). The energy sector has been seeing solid earnings results and this one has a great setup. If it breaks out, can it get to $48?

I don’t know, but that’s my short-term upside target. If it fails, it could see $42 on the downside.

Bret Kenwell is the manager and author of Future Blue Chips and is on Twitter @BretKenwell. As of this writing, Bret Kenwell

No comments:

Post a Comment